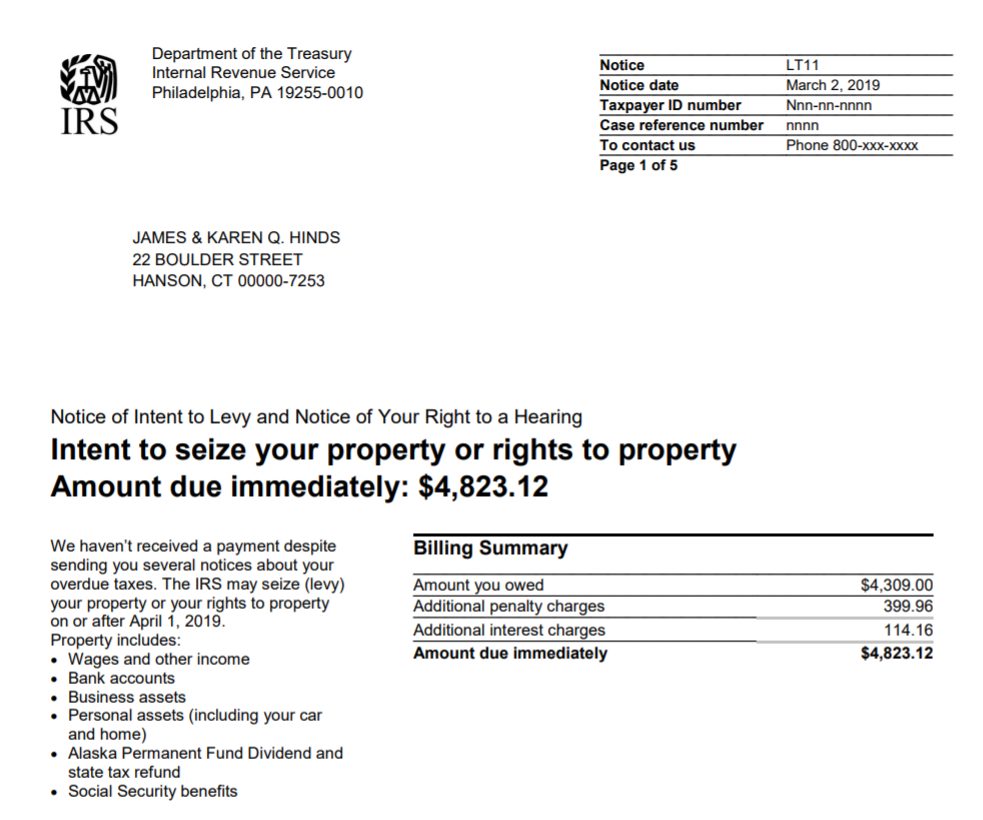

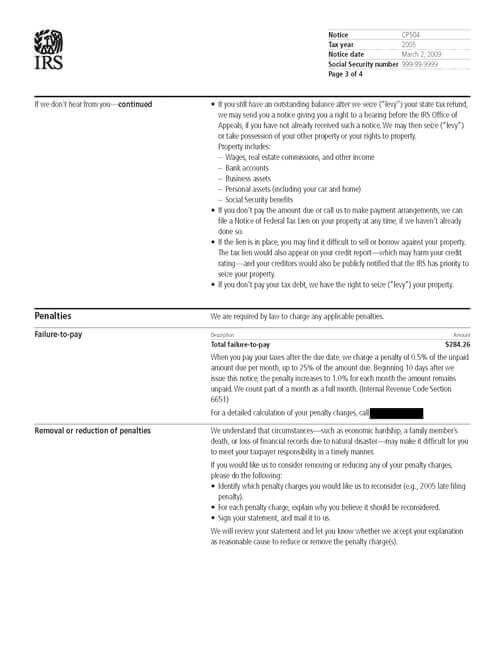

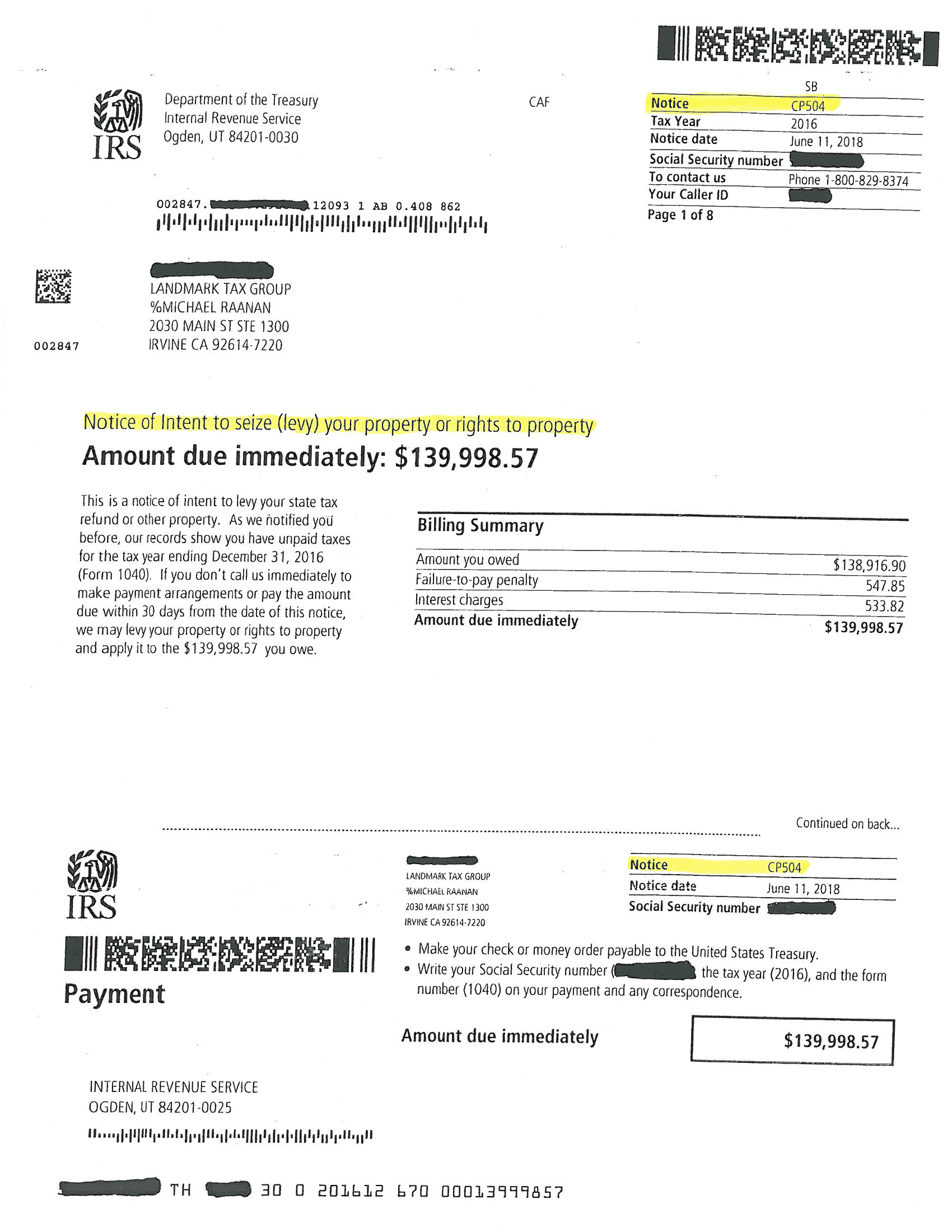

IRS Just Sent Me a Notice of Intent to Seize (Levy) Your Property or Right to Property (CP 504) – What Should I Do? | Legacy Tax & Resolution Services

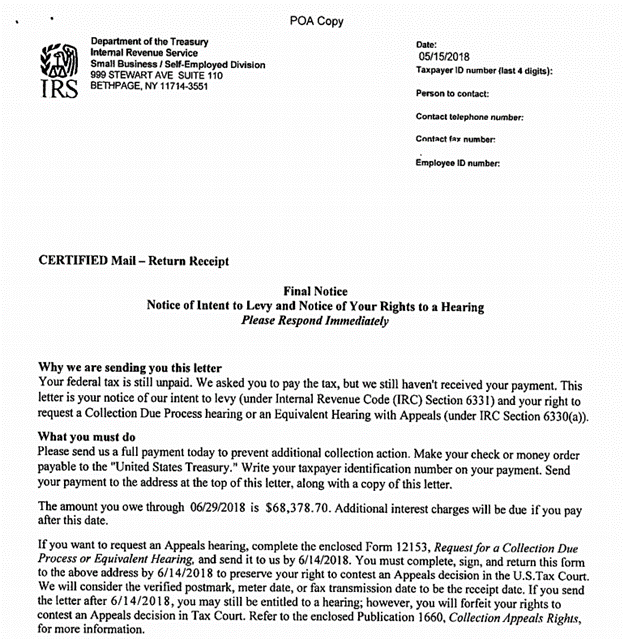

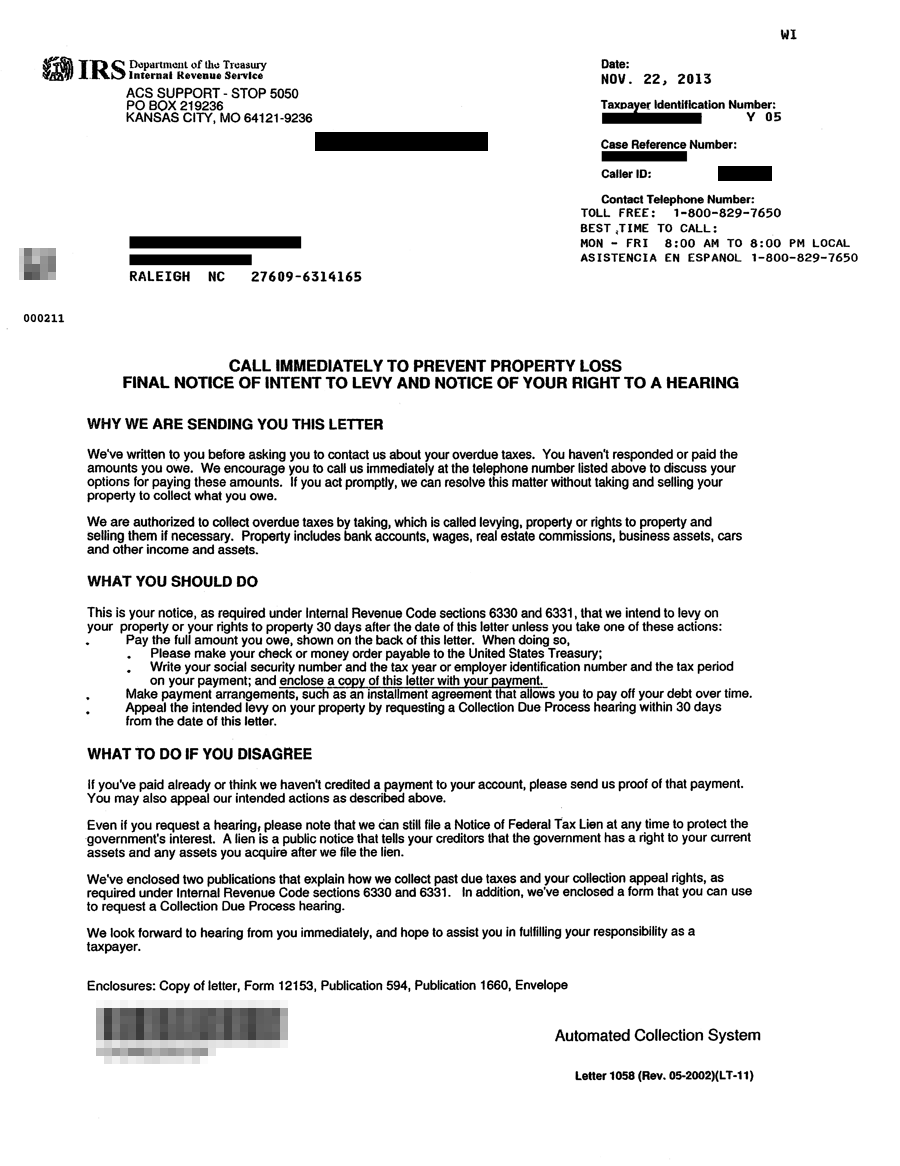

The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to a Hearing. What should you do now? | Brandon A. Keim - Phoenix Tax Attorney

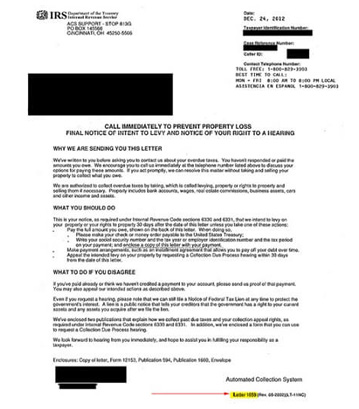

M&M Tax Relief on Twitter: "Oh yeah, we can get IRS bank levies released too. 1 for a client in Arizona and 1 for a client in North Carolina. But, we prefer